Continuous Data Protection for Financial Services

PK Protect delivers a comprehensive data-centric solution that helps BFSI organizations comply with mandates and reduce risk. Trusted by 21 of the top 25 largest U.S. commercial banks, our platform empowers financial firms to discover and protect sensitive data across environments for simplified security.

Enterprise-Wide Security for Financial Institutions

Capabilities Designed for

Finance and Banking

Continuous Data Security, Everywhere

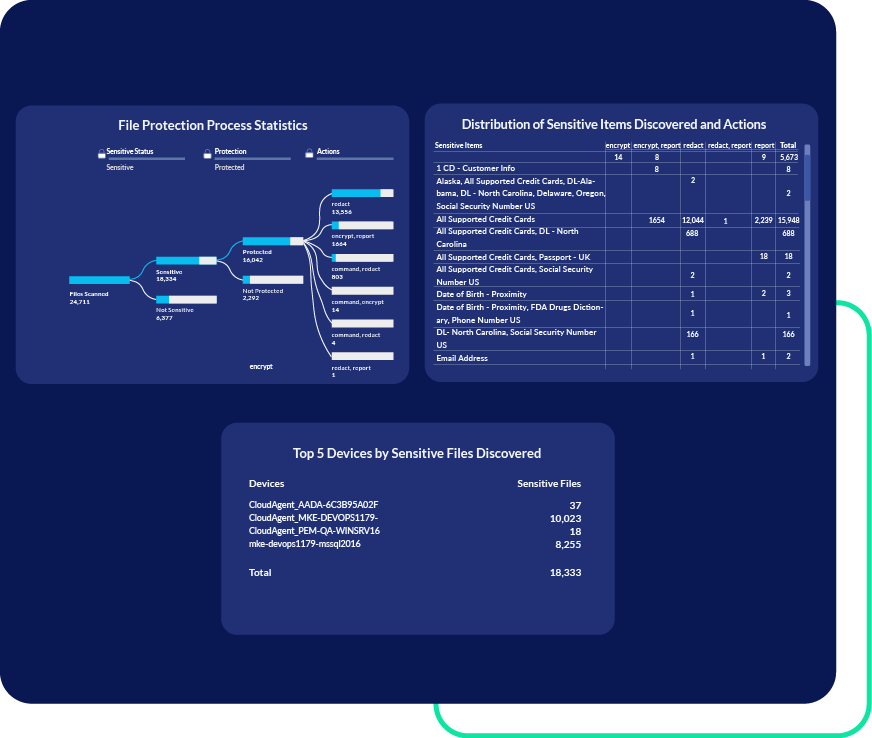

Discover and protect sensitive data automatically on endpoints, servers, databases, on-prem, cloud, and even mainframe. Our financial services data security platform reduces risk across your entire data landscape.

Modern Encryption, At Rest and In Transit

Regulations like GLBA and PCI DSS require encryption of data at rest and in transit. Traditional encryption methods are complex and disruptive. We provide modern policy-based, certificate-free encryption that secures files while preserving access for authorized users. Maintain compliance without hindering productivity.

One Platform for Data Security for Financial Institutions

Consolidate vendors with a unified solution for discovery and protection. Once PK Protect locates sensitive data, centrally defined policies can automatically redact, mask, encrypt, move, or delete data based on the content.